noema.agribusiness

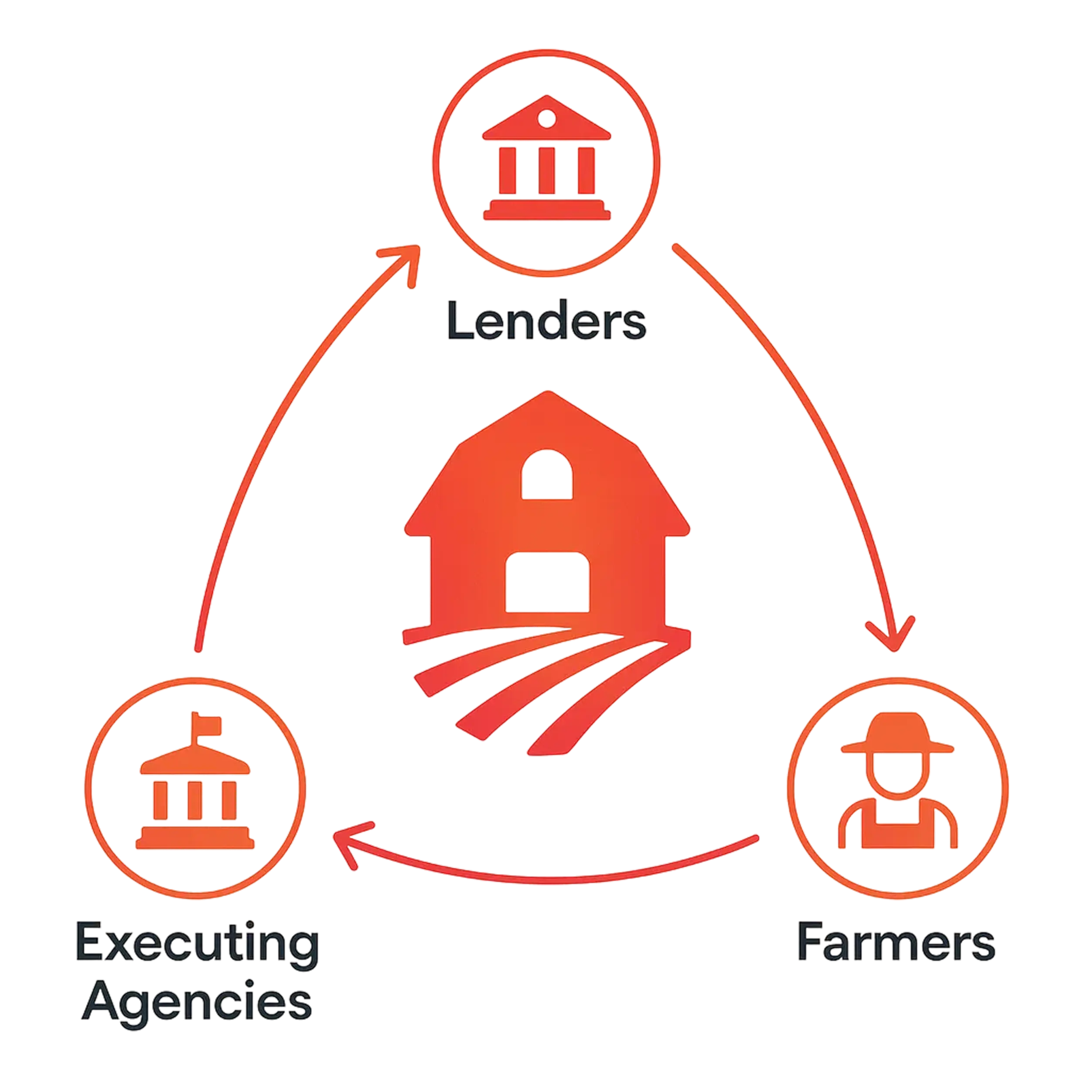

At the same time, it empowers executing agencies that design, regulate, and administer agricultural loan policies at national or regional level with transparent monitoring, performance insights, and compliance assurance.

Finally, it delivers an accessible, intuitive experience for farmers and loan applicants, enabling fast applications, clear eligibility guidance, and seamless engagement throughout the lending journey.

By aligning the needs of all three stakeholders, noema.agribusiness creates an efficient, and trustworthy financing ecosystem that strengthens agricultural productivity and financial inclusion.

A Purpose-Built Agricultural Lending Platform

noema.agribusiness is not a generic loan origination system. It is a specialised, end-to-end lending platform engineered for the realities, risks, and rhythms of the agricultural sector—where seasonality, weather, crop cycles, land usage, and volatile production conditions make traditional lending tools fundamentally inadequate.

Built on top of SAP BTP + SAP CML, the solution combines deep industry workflows, advanced analytics, and an ecosystem of integrations to give financial institutions a level of visibility, precision, and automation that standard LOS products simply cannot offer.

Comprehensive Coverage of Agricultural Lending Products

Agricultural finance requires flexibility across multiple credit instruments, each serving distinct needs of farmers, agribusinesses, and input suppliers. noema.agribusiness supports a full suite of lending products already implemented and operational in the solution: