noema.agribusiness

Modern financing tools for modern farmers

noema.agribusiness is not a generic loan origination system. It is a specialised, end-to-end lending platform engineered for the realities, risks, and rhythms of the agricultural sector—where seasonality, weather, crop cycles, land usage, and volatile production conditions make traditional lending tools fundamentally inadequate.

Built on top of SAP BTP + SAP CML, the solution combines deep industry workflows, advanced analytics, and an ecosystem of integrations to give financial institutions a level of visibility, precision, and automation that standard LOS products simply cannot offer.

Purpose-Built Workflows Across the Entire Loan Lifecycle

Instead of adapting retail or SME lending flows to agriculture, noema.agribusiness delivers ready-made, agriculture-specific workflows that cover the full credit lifecycle:

-

Origination & Risk Appetite

Tailored flows for crop-based loans, livestock financing, working capital lines, investment loans, and seasonal renewals. -

Underwriting & Risk Evaluation

Structured steps for field visits, crop structure evaluation, deviz/cash-flow simulation, production capacity, land ownership checks, and agricultural scorecards. -

Servicing & Amendments

Automated processes for renewals, rollovers, restructurings, collateral updates, and mid-season adjustments. -

Monitoring & Early Warnings

Monthly/seasonal review cycles, risk indicators, covenant tracking, and color-classification workflows aligned with agricultural cycles. -

Collections & Remedial Actions

Guided processes for overdue management, repayment strategies linked to crop cycles, and risk-based intervention timing.

These workflows allow lenders to operate at scale during peak season, maintain consistency across teams, and ensure regulatory-grade traceability.

Built for Seasonal Products & Agricultural Realities

Agricultural finance is defined by seasonality—cash inflows, risks, and repayment capacity change dramatically throughout the year.

noema.agribusiness supports:

- Multi-season lending structures

- Seasonal principal/interest profiles

- Rolling renewals based on past performance

- Crop-specific disbursement and repayment patterns

- Provisioning rules aligned with agricultural cycles

The system understands the economics of farming, not just the mathematics of loans.

Advanced, Agriculture-Focused Risk Assessment

Our specialised risk engine incorporates factors that generic credit systems overlook:

- Crop yield history

- Soil quality and land ownership structure

- Livestock output

- Weather risk exposure

- Input cost trends

- Regional/county-level production patterns

- Farmer quality indicators and behavioral data

- Detailed cash-flow simulations

The result is a true sector-specific creditworthiness model, delivering more accurate approvals and reducing NPL risk.

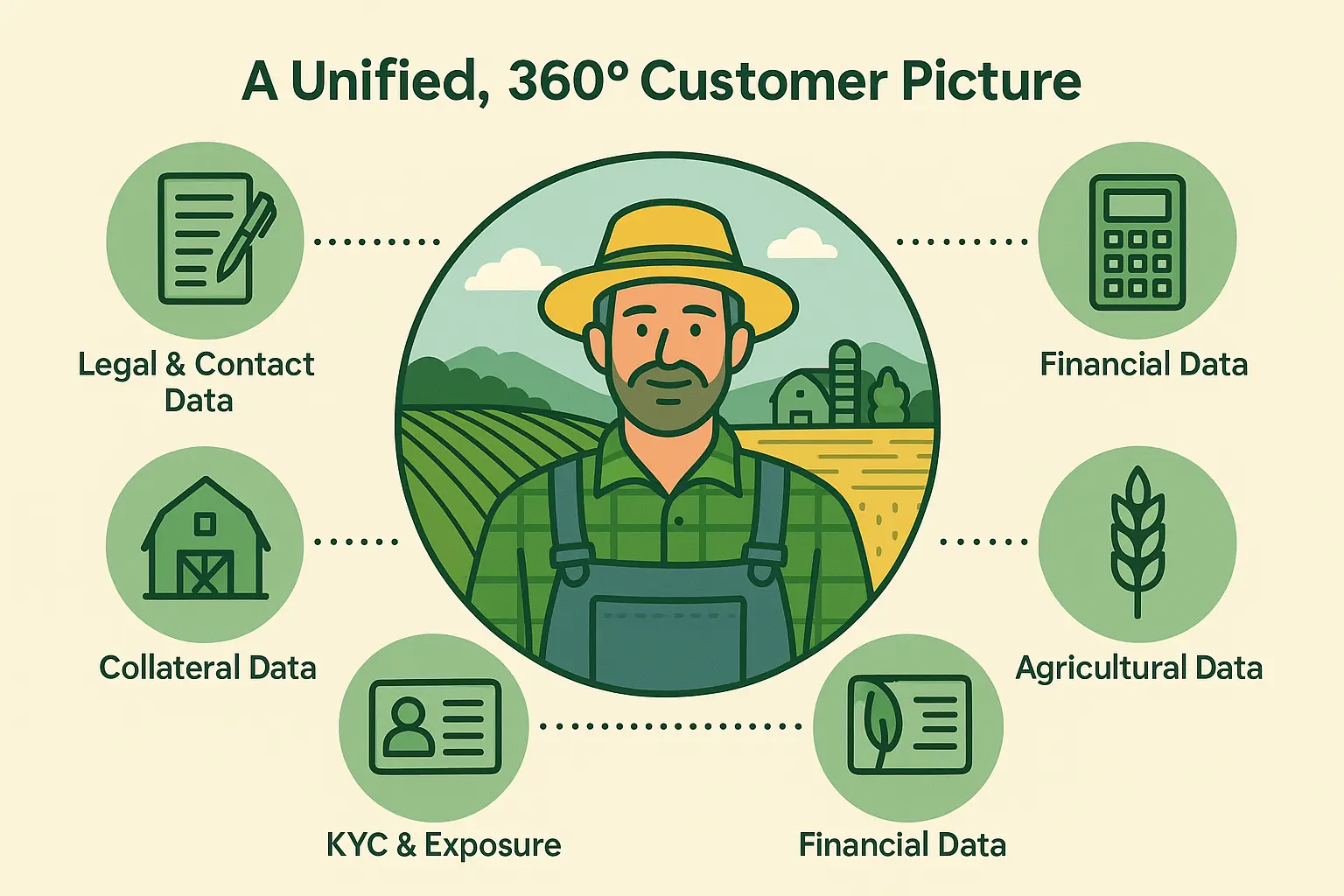

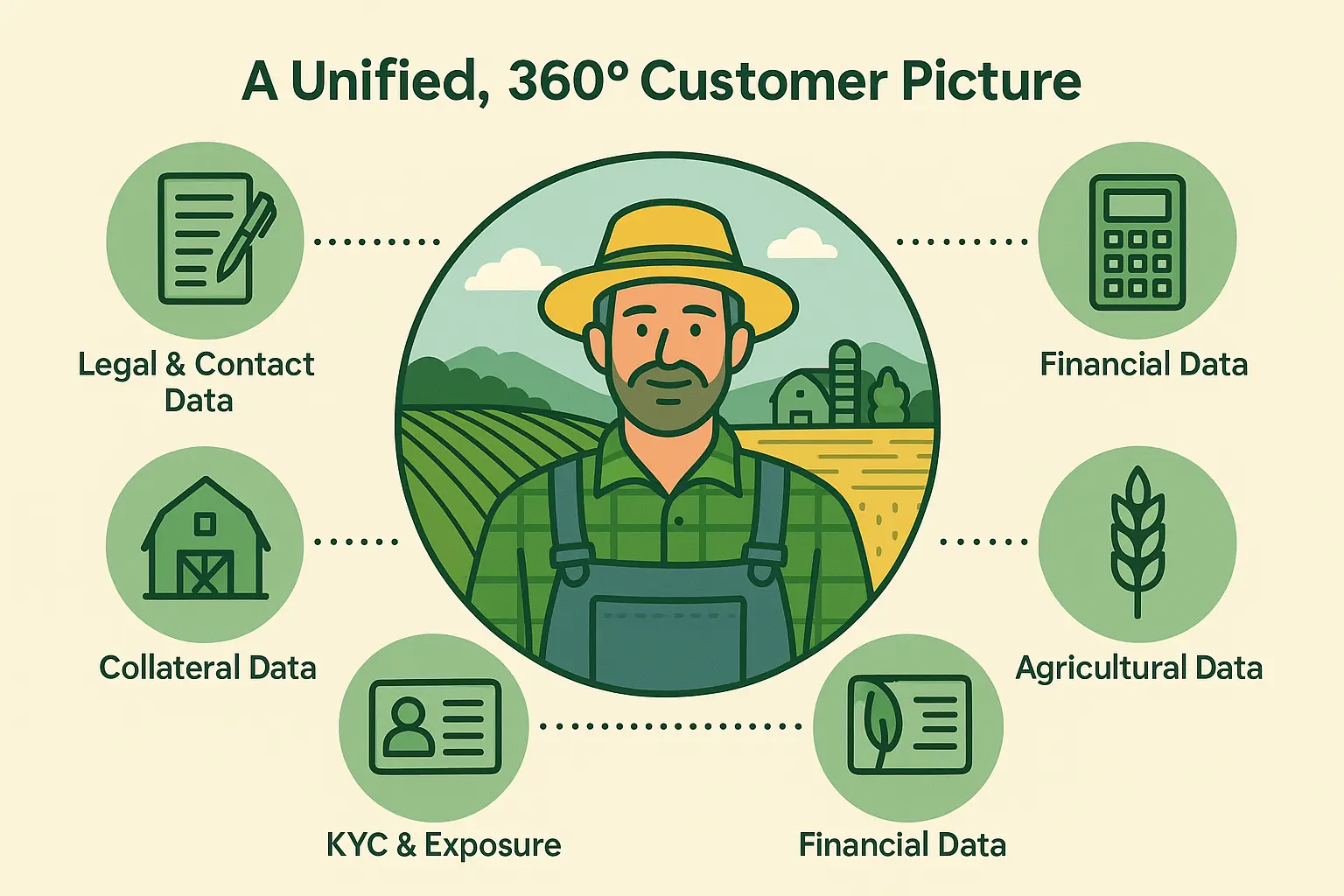

Custom Dashboards, 360° Insight & Unified Reporting

Agricultural lenders rely on dozens of disconnected data sources.noema.agribusiness consolidates everything into a single, real-time 360° view of the applicant and their business:

- Financial statements

- Crop structure & farm characteristics

- Exposure & collateral

- Historical performance

- Scoring results

- Weather and regional indicators

- External bureau checks

- Internal behavioral patterns

- Historical analytics and season-based trends

Dynamic dashboards and SAC-driven analytics provide branch, risk, management, and collection teams with powerful insights at every step.

Deep Integration Capabilities — Internal & External Data, Unified

Agricultural decisions depend heavily on timely information.

Our platform integrates seamlessly with:

- Financial & legal data providers (KYC)

- Agricultural agencies & registries

- OCR pipelines for invoices, land certificates, livestock documents

- ERP, CRM, DMS, Payment systems, SFTP channel integration

- RPA robots for bulk checks and seasonal workloads

- Field officer applications and mobile tools

This unified data layer eliminates inconsistencies and empowers lenders with complete, reliable, cross-validated data.

Hyperfocused AI Agents for Agricultural Decision Support

noema.agribusiness introduces AI agents trained specifically on agricultural lending patterns, enabling:

- Seasonal performance predictions

- Early-warning identification

- Risk pattern detection across crops, regions, and years

- Automated data extraction and classification

- Recommendation insights for underwriting, monitoring, and collections

- Portfolio stress testing under weather or market scenarios

These agents help lending teams make faster, smarter, data-supported decisions, even in complex or volatile market situations.

A True Specialist Solution for Agricultural Finance

With its purpose-built workflows, seasonal product support, specialised risk engine, deep integrations, and AI-enhanced insights, noema.agribusiness provides all the capabilities that agricultural lenders require—without the compromises of generic loan systems.

It is, quite simply, a complete agrifinance platform, designed with and for institutions that finance farmers, agribusinesses, and rural enterprises.